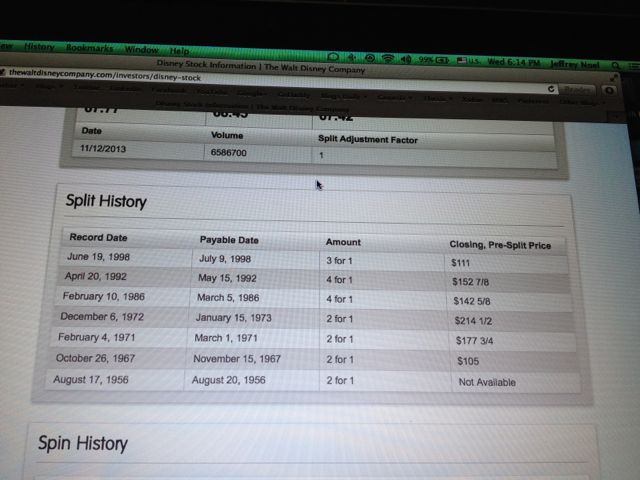

Meeting with Wells Fargo this morning to discuss rolling over the Disney 401k, managed by Fidelity Investments.

Fidelity would like it to keep it in the family – rollover the corporate 401k into a different Fidelity investment opportunity. This would eliminate any (albeit remote) possibility of a “claw back‘.

While claw backs are highly unlikely with a company like Disney, there are no guarantees.

There have been real life examples where companies have collapsed (remember Enron) and 401k nest eggs destroyed.

Next Blog