Even at age 58, there are still (obvious) lessons that will be learned later in life.

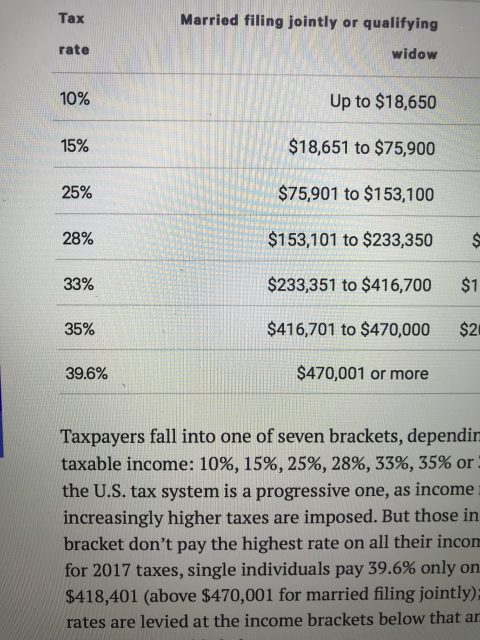

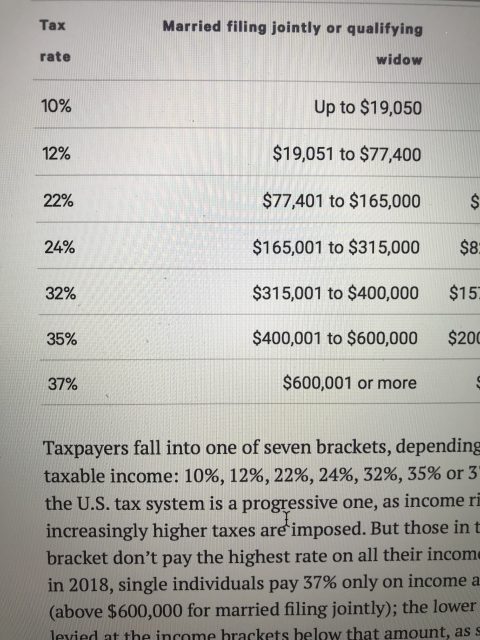

For example, for year-end contracts, it may be beneficial to postpone revenue until the next year.

• • • • •

This website is about our WORK. To ponder today’s post about our HQ, click here.

If you want to stay on this site and read more posts from this Blog, click here.